How to execute your estate plan

by Admin

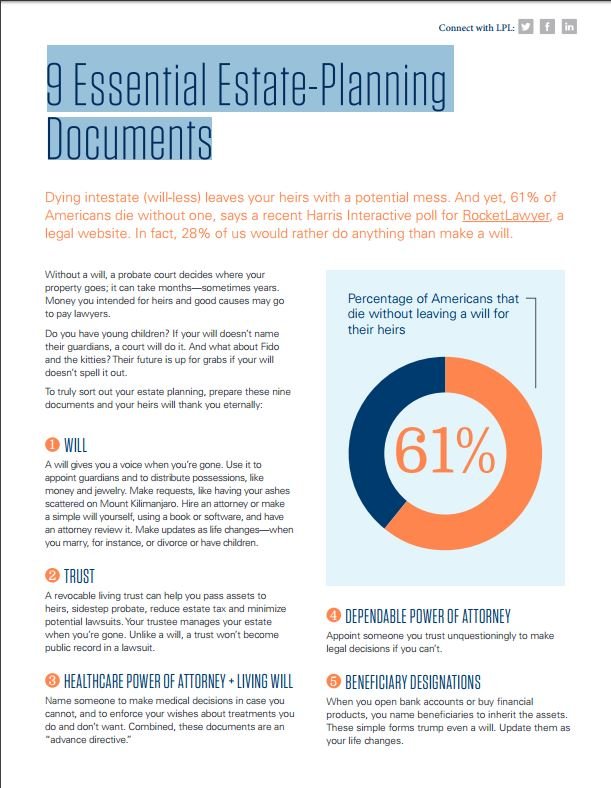

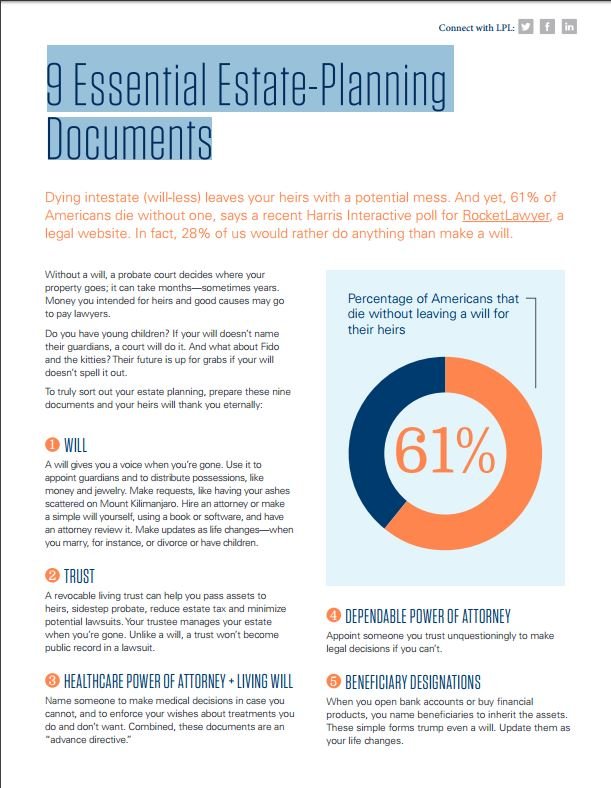

Posted on 07-06-2024 03:21 PM

By “formal” documents, i mean documents that have legal effect.

For example, you have most likely heard of at least two formal estate planning documents: a last will and testament and a living trust. Both a will and a trust can say what happens to your stuff after you die. And even though there are some major differences between wills and trusts , both can be legally enforced if properly executed — though it’s important to remember that wills are subject to probate. Other formal estate planning documents can give someone the legal authority to take care of your self.

For example, you have most likely heard of at least two formal estate planning documents: a last will and testament and a living trust. Both a will and a trust can say what happens to your stuff after you die. And even though there are some major differences between wills and trusts , both can be legally enforced if properly executed — though it’s important to remember that wills are subject to probate. Other formal estate planning documents can give someone the legal authority to take care of your self.

There are many sources for estate planning offered on the internet or by various organizations, and the incentive to avoid attorneys’ fees is often a motivating factor. However, the advantages of spending some money up front to have a well thought out and drafted plan, which is properly executed so as to be enforceable after death, cannot be overstated. Some problems often encountered in self-d rafted documents that have not been at least reviewed by an attorney include: not having enough witnesses, improper execution of the documents by witnesses, failure to properly authenticate the signatures and failing to include the necessary acknowledgements by the witnesses such as finding the signer to be of sound mind.

When to update your estate plan or make a new one

You can hire an attorney or estate tax professional to help create your estate plan, but whether you need one depends on your situation. If your estate plan is simple and straightforward, then you might be able to use an online program to write your will and file legal directives. These programs walk you through the process using an interview template. It will ask questions about where you live, your finances and your assets. You can later update your estate plan if needed. If your situation is more complicated or you’re unsure about whether it’s done correctly, it might be worthwhile contacting a professional.

While there is some time and expense associated with estate planning, the process helps ensure that your assets are handled per your wishes after you are gone. While everyone’s situation is different, some of the primary benefits of working with an estate planning attorney include: creating an individualized plan based on your specific needs and offering you the most valuable legal advice for your situation working with an experienced attorney who is knowledgeable about current estate planning laws in your state, ensuring that the decisions you make will be made in accordance with the law and are legally enforceable access to a specialist who can serve as a resource for questions, concerns, changes, and updates to your will and trust.

Beneficiary designations provide the ability to transfer assets directly to specific individuals, with or without the existence of a will. This happens when you open a bank account, retirement account, or life insurance policy and are asked to designate beneficiaries in the event of your death. As part of your estate plan, you can regularly review the beneficiary designations of these accounts and update them if needed. A beneficiary designate will typically precede what is written in a will. This is because the entity responsible for administering the account, such as a bank or life insurance company, will transfer the asset to the chosen beneficiary.

Estate planning for your life situation

Like a life estate, an irrevocable trust is often a tool for estate planning. The irrevocable trust removes assets from the grantor's estate. Specifically, the grantor relinquishes all rights to some assets and income, transferring them to a trust. The assets may be cash, investments, or life insurance policies. The trust's beneficiary may be a spouse, the grantor's children, or a charitable organization. A life estate is also irrevocable. The life tenant can't alter the agreement without the consent of the remainderman after a life estate deed is filed. An irrevocable trust does have its uses, however. It can reduce a person's wealth on paper, transferring that wealth to family members.

To begin the inheritance planning process, you need to take these steps: make a list of all your assets and liabilities. You can’t prepare an effective inheritance plan without this information. And a legal or estate planning professional, no matter how skilled, can’t do anything without this starting point. Don’t forget frequently overlooked assets such as pension plans, life insurance policies, trusts of which you are a beneficiary, and inheritances you are likely to receive. Your heirs will inherit only your net assets, so you’ll need to compile a list of all your debts, including whether or not the debts are secured by certain property.

- so let's talk a little bit about something that frankly i do not like to talk about and i don't think most people like to talk about, and that's the notion of becoming very ill and dying, and then what happens to everyone that you leave behind? and to understand why this is an important scenario, let's imagine, and i'll just put myself in this scenario, hopefully this does not happen. Let's imagine a scenario where something like that happened to me and/or my wife without us doing any type of planning, any type of end of life planning, any type of estate planning.

Whether you are engaged in an estate dispute or are seeking representation for creating or updating an estate plan, our attorneys are here to provide you with knowledgeable advice and advocacy. To arrange your initial consultation, please call our law offices today. Your partner for success our attorneys are here to help you explore legal strategies that resolve today’s business disputes and prevent further disputes from occurring in the future. To learn more about how we can help you achieve your business law goals, call our law offices at 949-474-0940. Contact us.

Now that we’ve explained the various meanings of the word “estate”, hopefully it’s clear why estate planning is for everyone – because almost everyone owns some sort of assets that will need to be dealt with after you pass away. Seek the counsel of an experienced attorney for assistance. If you have any questions about this topic, feel free to contact our law firm.

A power of attorney , or poa, is an estate planning document to appoint an agent to manage your affairs. There are several different types of power of attorney. Each serves another purpose and grants varying levels of authority to your agent. It’s essential to ensure you choose the right type of poa to meet your needs. For example, medical power of attorney gives your agent the authority to make health care decisions on your behalf. In contrast, a general power of attorney allows an agent to handle your fiscal and legal affairs. Therefore, you may want to include two or three types of power of attorney in your estate plan.